ETHANOL TO SUSTAINABLE AVIATION FUELS (SAF)

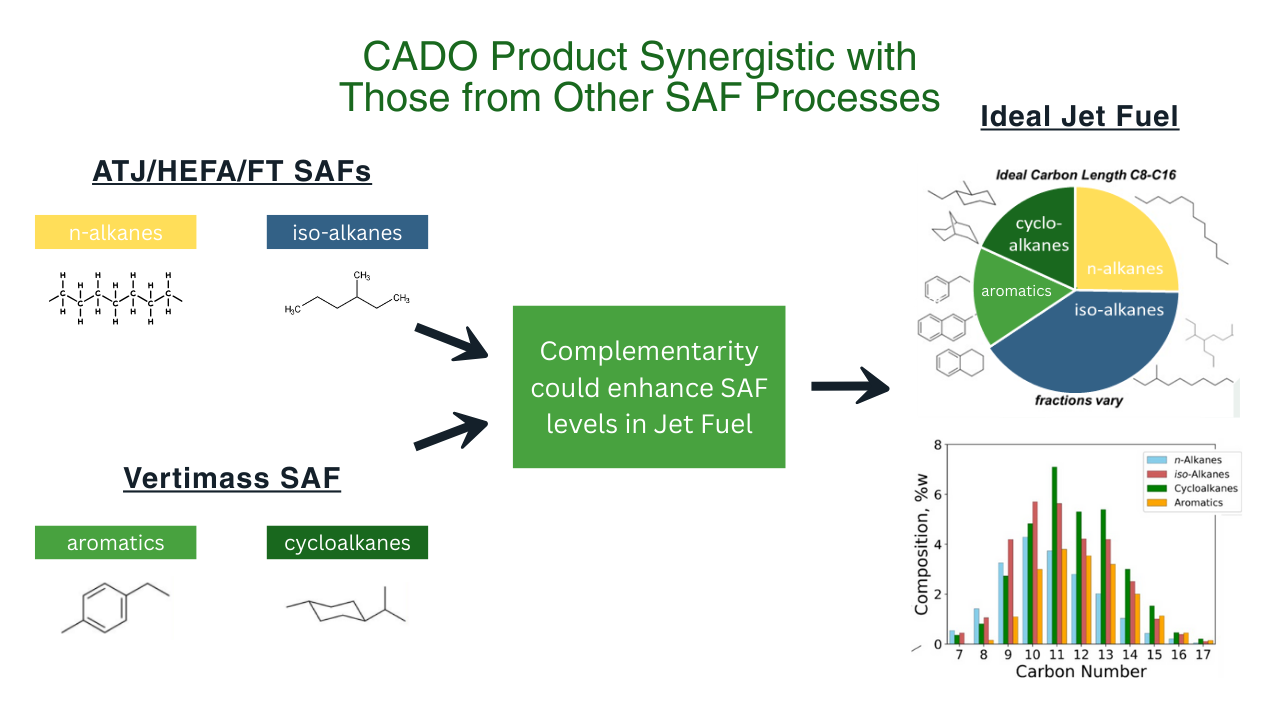

Vertimass CADO technology can convert a wide range of alcohols (methanol, ethanol, butanols) into sustainable aviation fuels (SAFs) that are enriched with aromatics and cycloparaffinic components. These two components represent nearly half of the ideal jet fuel composition and are critical for seal swelling and energy density.

Blending CADO aromatics and cyclo-alkanes with the paraffins and iso-paraffins predominately produced by ATJ, HEFA, FT, and other processes can result in SAF that replaces more or possibly all commercial petroleum derived jet fuel than possible by any of these products alone.

In fact, Vertimass SAF products are very complimentary to other SAF production technologies (conventional Alcohol-to-Jet (ATJ), hydroprocessed esters and fatty acids (HEFA) of waste oils, and Fischer Tropsch (FT)) that produce the other two components (isoparaffins, normal paraffins, top left Figure below) to produce an ideal jet fuel. The combination of Vertimass and conventional SAFs offers the potential to produce an ideal 100% SAF without any required petroleum inputs.

An investment in Vertimass must be considered speculative. There are no guarantees of distributions or returns, and an investor may lose all or part of their investment. There are various risks related to an investment in Vertimass which are described in the Private Placement Memorandum. These risks include:

- Emerging Growth Company: The Company is an emerging growth company that is not yet profitable, is without significant operating history, and may experience significant losses for some time after the Offering.

- Expectations of Future Losses: The Company is not currently profitable.

- Failure to Achieve Targeted Raise: As discussed above, the Company is seeking to raise up to an additional $45 million for use as working capital through the Offering (the “Targeted Raise”). In the event the Company is unable to raise up to the Targeted Raise, it may not be able to fund its operations as it presently anticipates.

- Illiquid Investment: Members of the Company are not permitted to withdraw their investment from the Company and therefore may have to bear the economic risk of an investment in the Company for a substantial period of time.

- No Assurance of Additional Capital: The success of the Company depends upon receiving significant funding from the net proceeds of this Offering, as well as additional financing.

- No Assurance of Distributions: Members may not receive any cash distributions.

- No Role in Management: Members will be unable to exercise any management functions with respect to the Company. The rights and obligations of the Members are governed by the provisions of applicable Delaware law and by the Operating Agreement.

- Projections: Any projected financial results prepared by the Company have not been independently reviewed, analyzed, or otherwise passed upon. Such “forward looking” statements are based on various assumptions of the Company, which assumptions may prove to be incorrect. There can be no assurance that such projections, assumptions and statements will accurately predict future events or actual performance.

- Changes in Fuel Prices: In recent years, the price of ethanol has been less than the price of petroleum-based fuels, which increased demand for ethanol and other comparably priced alternative fuels. However, the price of ethanol and petroleum-based fuels can drastically change over time so it is difficult to predict how fuel prices will be in the future.