Groundbreaking Vertimass Consolidated Alcohol Deoxygenation And Oligomerization (CADO) Technology

What is CADO?

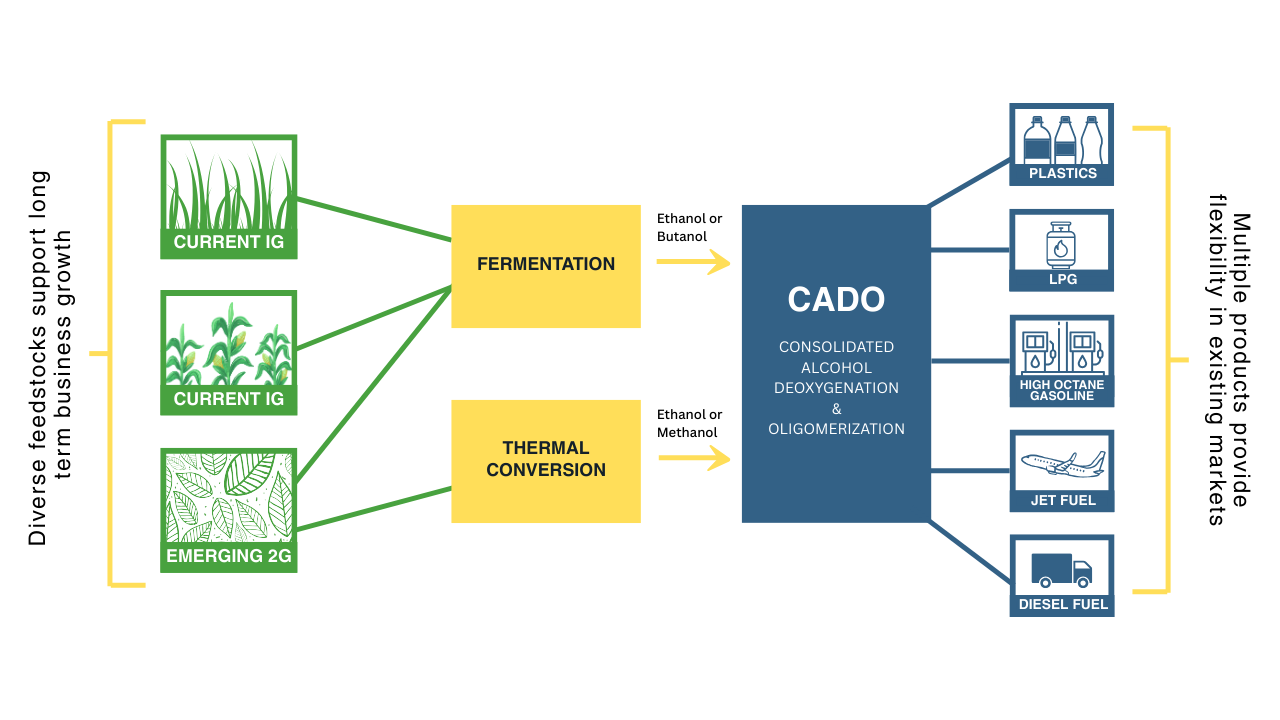

Vertimass is readying commercialization of its groundbreaking CADO catalytic technology to produce low-cost, low-carbon sustainable aviation fuels (SAFs) and high-octane gasoline blendstocks, as well as valuable chemicals and sustainable liquid gases (mainly propane and butane) from alcohols. The novel catalysts, initially created at Oak Ridge National Laboratory, are the key to this discovery.

As a simple bolt-on to existing or new ethanol plants, the process is designed to offer comparatively lower capital and operating costs. If proven commercially, this approach could be implemented more quickly and at lower costs than certain other platforms for producing hydrocarbons from biomass.

CADO is being developed with the aim of providing several advantages, including:

- Single step reactor system, which may reduce capital and operating costs compared to multi-step systems

- Potential for lower carbon emissions during conversion

- Laboratory studies showing high conversion rates of alcohols to hydrocarbons (actual commercial results may vary)

- High yields of valuable liquid fuels compatible with existing infrastructure

- Lower energy costs by processing mixed concentrations of alcohols in water

- Less energy use and carbon emissions through elimination of a hydrogen addition

- Reduced operating costs from operation at near atmospheric pressure and modest temperatures

- Robust commercial catalyst formulation

- Product flexibility

- Reduced environmental impact through release of water coproduct

A paper published in the prestigious Proceedings of the National Academy of Sciences (PNAS) provides additional CADO insights through contributions by 19 experts from 12 academic, industrial, and government laboratory organizations. These findings represent ongoing research and development and do not guarantee commercial performance.

CADO Versatility

CADO can use alcohols (methanol, ethanol, butanols) derived from a wide range of biomass feedstocks and convert them into a range of hydrocarbon fuels and chemicals that are compatible with existing fuels and chemical infrastructures.

Disclaimer: The CADO technology is under development and has not yet been fully commercialized. The benefits described herein are based on preliminary studies, modeling, and laboratory-scale testing. Actual results may differ depending on commercial deployment, feedstock availability, regulatory approval, and market conditions. Forward-looking statements are subject to risks and uncertainties.

An investment in Vertimass must be considered speculative. There are no guarantees of distributions or returns, and an investor may lose all or part of their investment. There are various risks related to an investment in Vertimass which are described in the Private Placement Memorandum. These risks include:

- Emerging Growth Company: The Company is an emerging growth company that is not yet profitable, is without significant operating history, and may experience significant losses for some time after the Offering.

- Expectations of Future Losses: The Company is not currently profitable.

- Failure to Achieve Targeted Raise: As discussed above, the Company is seeking to raise up to an additional $45 million for use as working capital through the Offering (the “Targeted Raise”). In the event the Company is unable to raise up to the Targeted Raise, it may not be able to fund its operations as it presently anticipates.

- Illiquid Investment: Members of the Company are not permitted to withdraw their investment from the Company and therefore may have to bear the economic risk of an investment in the Company for a substantial period of time.

- No Assurance of Additional Capital: The success of the Company depends upon receiving significant funding from the net proceeds of this Offering, as well as additional financing.

- No Assurance of Distributions: Members may not receive any cash distributions.

- No Role in Management: Members will be unable to exercise any management functions with respect to the Company. The rights and obligations of the Members are governed by the provisions of applicable Delaware law and by the Operating Agreement.

- Projections: Any projected financial results prepared by the Company have not been independently reviewed, analyzed, or otherwise passed upon. Such “forward looking” statements are based on various assumptions of the Company, which assumptions may prove to be incorrect. There can be no assurance that such projections, assumptions and statements will accurately predict future events or actual performance.

- Changes in Fuel Prices: In recent years, the price of ethanol has been less than the price of petroleum-based fuels, which increased demand for ethanol and other comparably priced alternative fuels. However, the price of ethanol and petroleum-based fuels can drastically change over time so it is difficult to predict how fuel prices will be in the future.